Key Insights:

- Terraform Labs proposes a $1 million penalty, countering the SEC’s initial $5.3 billion fine demand.

- Terraform argues that the funds in question are held by Luna Foundation Guard and are not subject to SEC claims.

- Ripple also counters SEC with a significantly lower fine suggestion, proposing $10 million against $2 billion.

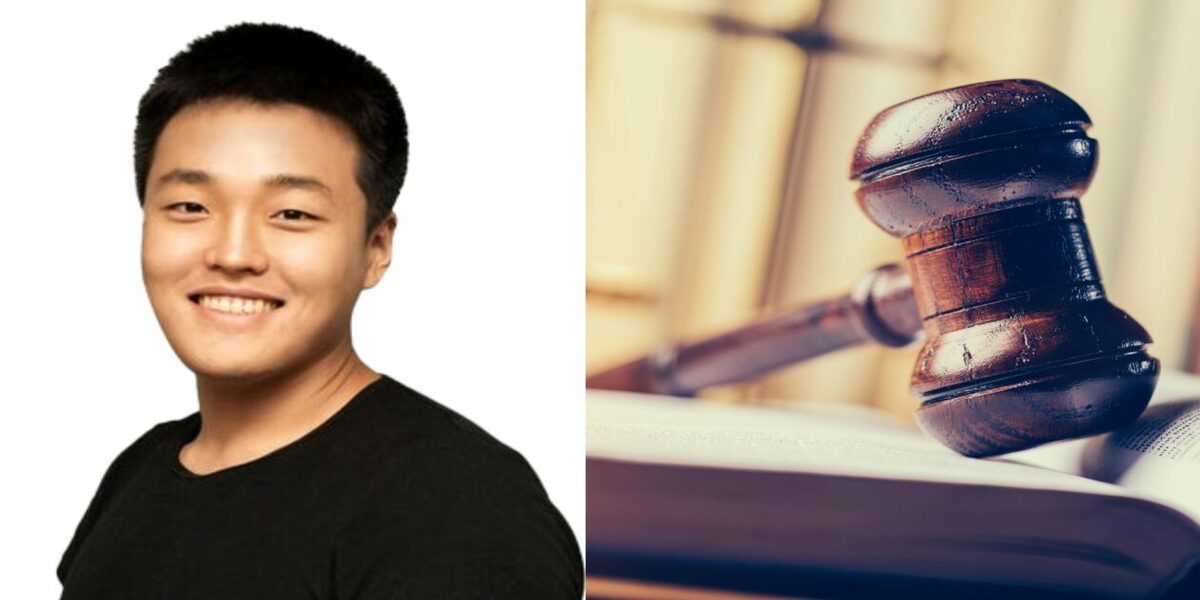

In a recent court filing, Terraform Labs strongly contested the U.S. Securities and Exchange Commission’s (SEC) proposed penalty of $5.3 billion, suggesting instead a maximum of $1 million. This move comes after the SEC demanded substantial disgorgement and civil penalties following the jury’s fraud verdict against co-founder Do Kwon and the company.

Terraform’s attorneys argue that the $5.3 billion figure is excessive. They propose that only a fraction of that amount is justifiable. The crux of their argument lies in the responsibility for the funds generated by token sales. They claim these were conducted by Luna Foundation Guard (LFG), not Terraform Labs. Hence, they contend that the SEC improperly targets Terraform for funds it never controlled.

Additionally, the legal team has challenged the SEC’s authority to enforce disgorgement from LFG since it was not named in the case. They insist that without this designation, the SEC’s pursuit of LFG’s funds is legally baseless. Therefore, they recommend dismissing any injunction or disgorgement orders and capping the civil penalty at $1 million.

The saga of Terraform Labs highlights broader regulatory scrutiny facing the crypto industry. The firm, along with Ripple, has been entangled in legal disputes over alleged violations of securities laws. These cases have broader implications for the sector’s regulatory landscape.

Moreover, the context of Do Kwon’s legal troubles adds complexity to Terraform’s position. With Kwon detained in Montenegro under travel restrictions, the international legal proceedings involve multiple jurisdictions, including potential extradition to the U.S.

The SEC also seeks to prohibit Kwon from serving as an officer or director of any securities issuer. This development further underscores the severe ramifications of the case for Kwon and Terraform Labs.

The financial repercussions of Terraform Labs’ $40 billion collapse in 2022 have already had widespread effects, contributing to the bankruptcies of several other crypto firms. Terraform itself sought Chapter 11 bankruptcy protection earlier this year.

Meanwhile, Ripple, another crypto firm under the SEC’s scrutiny, has also resisted the regulator’s severe penalty proposals. Ripple’s legal team argues for a significantly reduced fine of $10 million, contrasting sharply with the SEC’s $2 billion suggestion.