Highlights:

- President Biden vetoed a bill to overturn the SEC’s SAB 121, emphasizing consumer and investor protection.

- SAB 121 mandates financial institutions to record crypto assets as liabilities, facing opposition but defended by the SEC.

- Overturning the veto requires a two-thirds majority in both houses, reflecting the ongoing regulatory tension in the crypto industry.

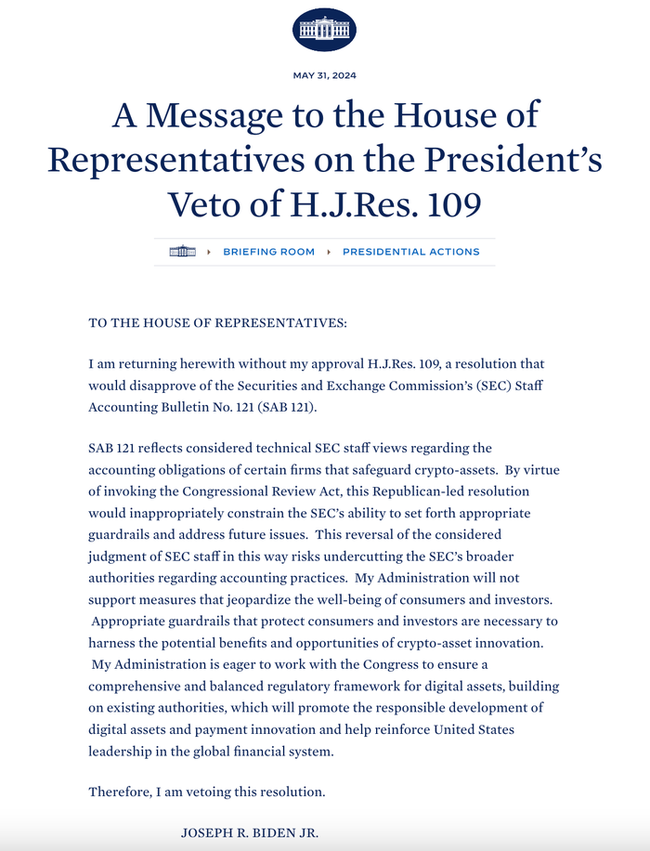

President Joe Biden vetoed a bill to overturn the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 (SAB 121). The veto underscores the administration’s commitment to maintaining robust regulatory frameworks for cryptocurrencies, prioritizing consumer and investor protection.

JUST IN: Biden vetos the bill that would revoke the SEC’s SAB 121, maintaining the ban on large financial institutions from taking custody of #Bitcoin 😮 pic.twitter.com/6V0Ih0A987

— Bitcoin News (@BitcoinNewsCom) May 31, 2024

Biden’s Stance on Crypto Regulation

President Biden’s veto reflects his administration’s stance on protecting financial stability and investor interests. The White House released a statement emphasizing the importance of comprehensive regulatory frameworks for the burgeoning crypto market. “Limiting the SEC’s ability to build crypto regulatory frameworks could pose major risks to financial stability,” Biden asserted.

The vetoed bill, supported by a bipartisan majority in the House and Senate, aimed to rescind SAB 121. This bulletin requires financial institutions holding crypto for customers to record these assets as liabilities on their balance sheets. Critics argue that this makes it difficult for banks to offer custodial services for digital assets.

SEC’s Role in Crypto Oversight

SAB 121, introduced by the SEC, has been a point of contention within the crypto industry. Many believe this guidance restricts financial institutions’ ability to manage crypto assets effectively. However, the SEC defends SAB 121 as “non-binding staff guidance” that enhances transparency and investor protection.

An SEC spokesperson highlighted the risks associated with insufficient disclosure of crypto holdings, stating, “These disclosures provide investors important insight into the level of risk taken by crypto custodians.”

Political Implications and Industry Reactions

The repeal effort saw significant support in Congress, with the House passing the measure with a 228-182 vote and the Senate approving it 60-38. Despite bipartisan backing, Biden’s veto maintains the status quo, reinforcing the SEC’s authority over crypto regulations.

Ripple CEO Brad Garlinghouse expressed his disappointment with the veto, urging the administration to reconsider its stance. “If the Biden administration is actually serious about a shift… the single most important thing they can do is demand the resignation of Gary Gensler,” Garlinghouse stated.

If the Biden administration is actually serious about a shift (and finally waking up to the crypto electorate) – the single most important thing they can do is demand the resignation of Gary Gensler. https://t.co/PRiWDXV0HE

— Brad Garlinghouse (@bgarlinghouse) May 31, 2024

Challenges Ahead for Lawmakers

Overturning Biden’s veto requires a two-thirds majority in both houses of Congress, a challenging feat given the current political landscape. The administration’s decision aligns with Biden’s previous comments on ensuring robust regulatory frameworks for the crypto industry. “Appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of crypto-asset innovation,” Biden reiterated.

The controversy surrounding SAB 121 highlights the ongoing debate over the best approach to regulating the fast-growing crypto market. While some lawmakers and industry players argue for more lenient regulations to foster innovation, the Biden administration maintains strict oversight to prevent financial instability and protect investors.