When it comes to the best crypto trading strategy, there is need for adequate crypto trading knowledge to be able to ascertain the best crypto trading strategy.

Over the years, professional crypto traders are known by the best crypto strategy that works for them. As the usual quote that says “one mans food another mans poison” is dominant in the crypto space.

In the crypto trading space, you have to work with the best trading crypto strategy that works for you, as we have different strategies.

Best Crypto trading Strategy

In determining the best crypto trading strategy, we have to look at these two trading methods.

Indicators trading strategy

There are lots of indicators that traders use in the crypto space, but analysis have shown that the forex markets are more stable in terms of indicators proficiency. Indicators like moving averages and RSI are still useful for crypto traders, but in the course of this article the best crypto trading strategy is from price actions and not from indicators.

We however use indicators to establish trading analysis confluence(agreement in analysis) with our price actions strategies.

For example, when the 200MA (moving Average) is lower than the current price(which signifies buying strength), and from analysis you find the current price is at a support(which also confirms buying strength). This means that trading confluence has been created, as the two analysis points to a buying opportunity. So we use indicators to confirm our market choices, not to execute trades.

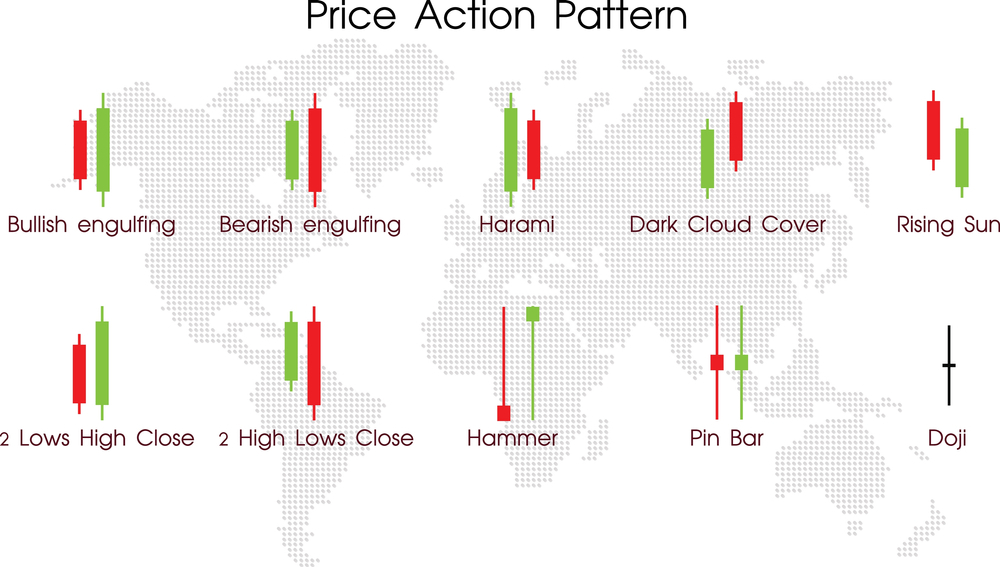

Price Action Strategy

Price actions has proven to be the best crypto trading strategy in the crypto space, especially as Bitcoin’s dominance continue to increase. Some candlesticks movement can show the next move as trading is concerned. Understanding candlesticks pattern is one the first step to Understanding price action strategy.

Currently, Bitcoin’s price actions affect the prices of many cryptocurrencies (Alt coins) in the crypto market.

Making use of price actions, we need to understand the levels where the markets reacts the most, because the chance of the same price movement at the new level is possible.

At this we need to look at resistance, support, trending, and ranging/consolidating systems to understand price actions.

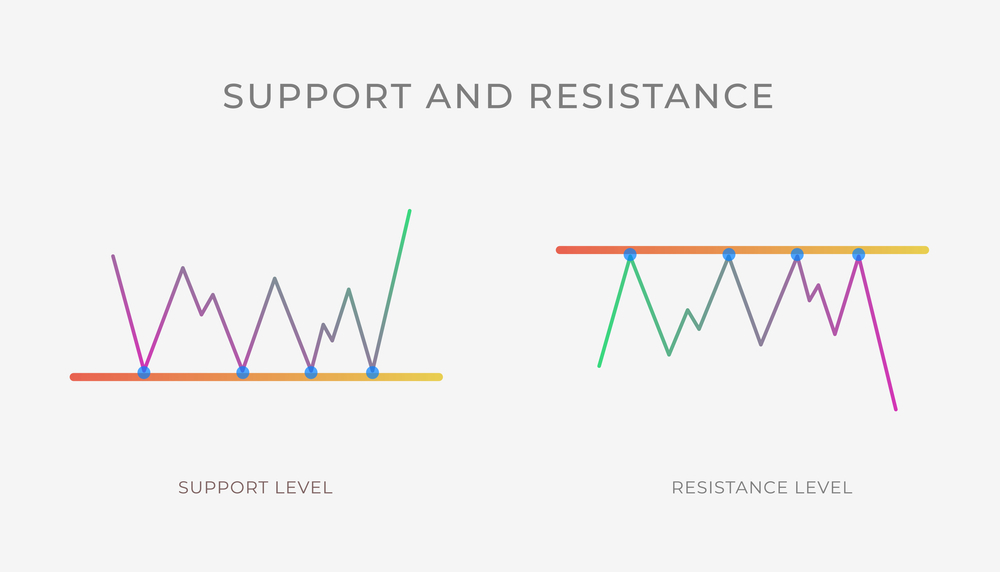

Resistance

In a crypto market, resistance refers to the price level where an uptrend is expected to end due to an increase in supply and selling strength. It is simply seen as the price level where price often respect and start going down.

Normally when there is increase in price, and it gets to a resistance zone, the price will be rejected there.

Support

In a crypto market, support refers to the price level where a downtrend is expected to end due to an increase in demand and buying strength. It is simply seen as the price level where price often respect and start going up after declining.

Normally when there is decrease in price, and it gets to a support zone, the price will be rejected there.

Trending Market

Trending markets are divided into uptrend and downtrend.

Uptrend

When a market is moving high especially in higher highs and lower lows, we say the market is in an uptrend.

Downtrend

When a market is moving down especially in lower high and lower low, we say the market is in a downtrend.

Ranging/consolidating market

This type of market is neither moving up nor moving down. It is a place of indecision between buyers and sellers. And sometimes has equal high and lows in long frame chart(straight chart).

After knowing the above market price movement levels, we have to understand the strategy used in trading all of them.

- In an uptrend market: always enter the trade at a retracement price level. Never enter the market when its buying, enter at a retracement level.

Note: Retracement is the little price direction change that occurs during trends.

- In a downtrend market: Always enter in retracements price levels too and not when the market is selling.

- In a ranging market: A ranging market at times have levels where prices respect, and they show some resistance and support too. So you can sell at resistance and buy at supports in a ranging market. Otherwise you can leave the market.

Conclusion

Market price actions have always shown advantages than other market strategies, so it is better to use price action with confluence with other strategies.

However, you are adviced to do your own research and trade at your own risk as the article is for informational purposes and not a financial advice.