Profitable trading is all about understanding what is happening on the chart and the market structure tells you a story of what price have been doing over time and what may likely happen in the future.

Every trading chat is a story about what price is doing over time and this story is told using candlesticks, bar charts, or lines.

If you see it to be complex, it will be extremely complex but if you see it as just a story about buyers and sellers playing around with price to make a profit, it will be easier.

Market Structure

I will be making this as easy as possible and well-detailed for your understanding.

Market structure is one of the most important concepts that everyone willing to make money from trading must understand.

If you can learn and master how to analyze the market structure, you are sure of stepping into the next level of trading that will completely transform and elevate your life amazingly.

Let us dive into the market trends and structural breaks.

Types of Trend

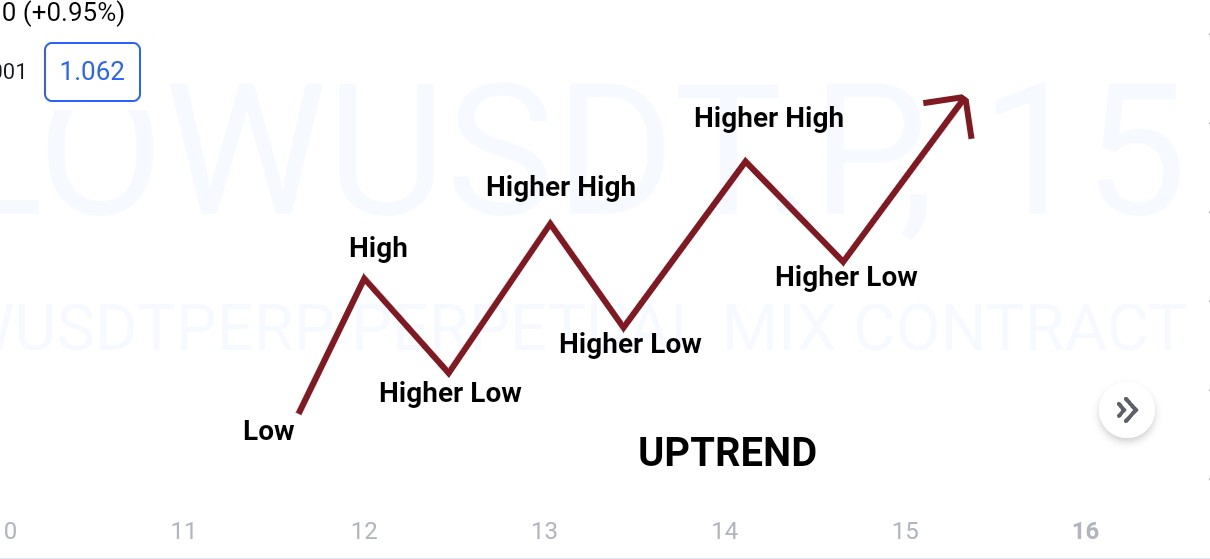

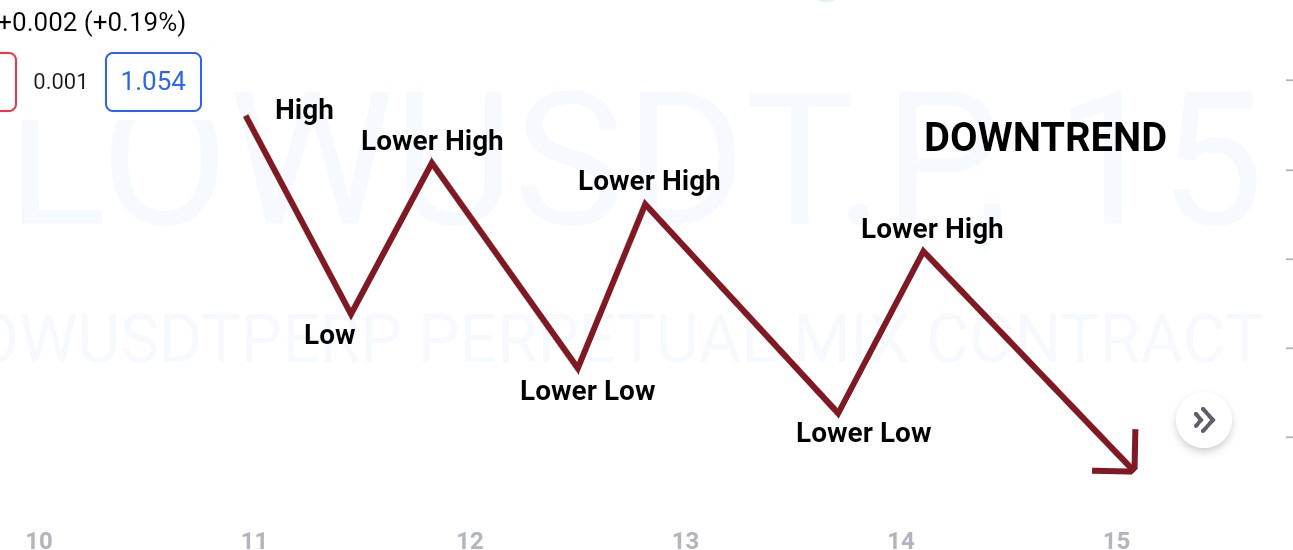

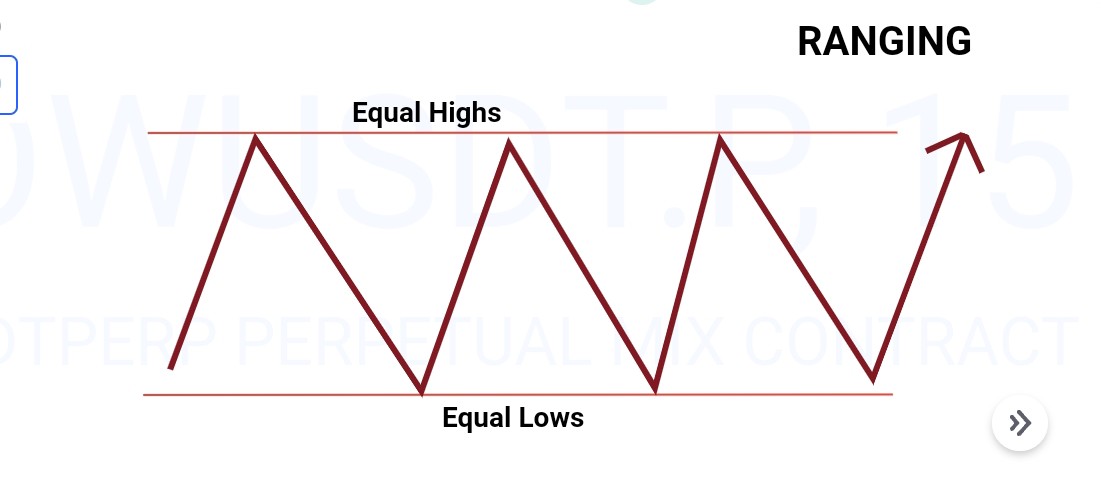

The market trends upwards, downwards, or sideways (ranging).

These movements form swing points; higher high (HH), Higher low (HL), Lower high (LH), and Lower low (LL).

Uptrend

The market is in an uptrend when it is printing a series of higher highs (HH) and higher lows (HL).

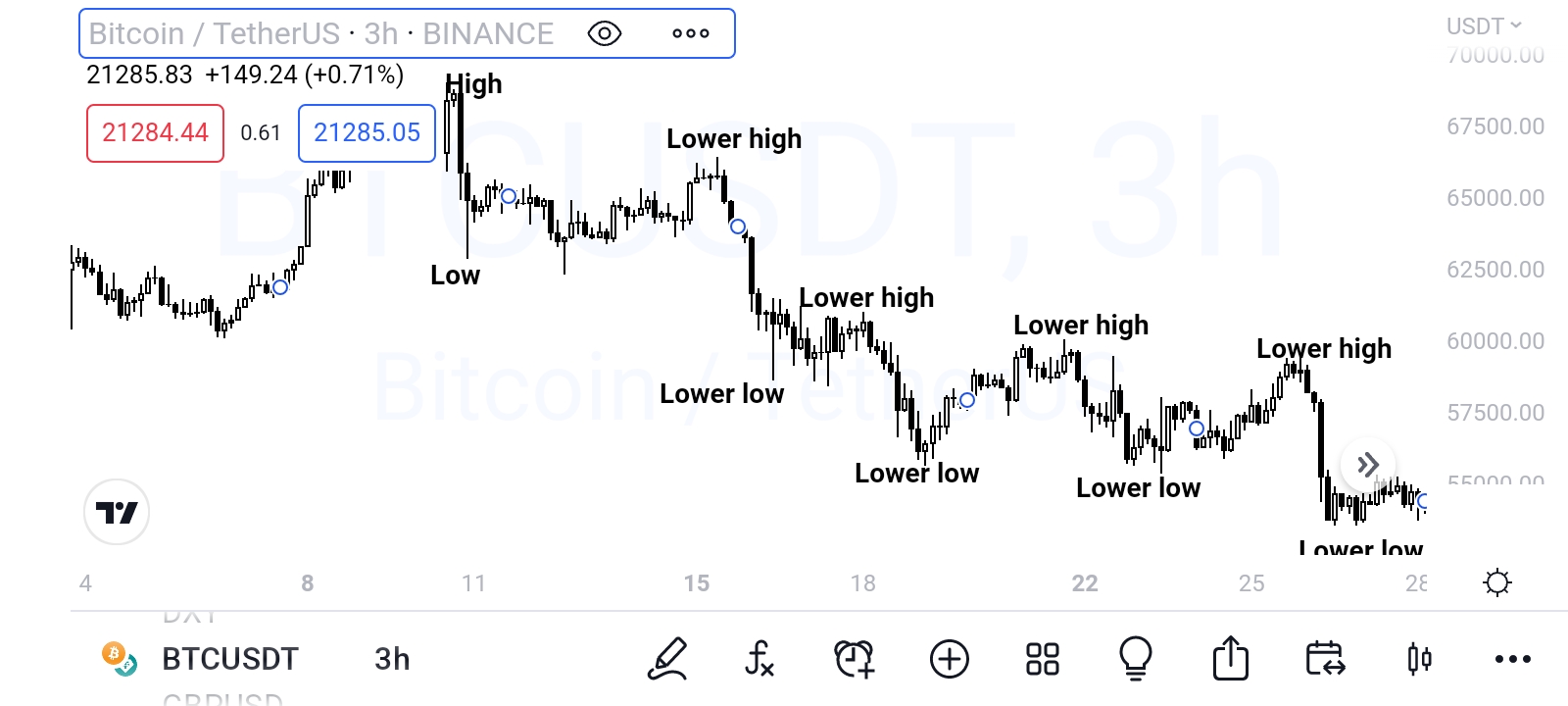

Downtrend

The market is in a downtrend when it is printing a series of Lower lows (LL) and lower highs (LH).

Ranging market

This is when the market is neither moving upwards nor downwards but can be seen moving sideways within a support and resistance zone.

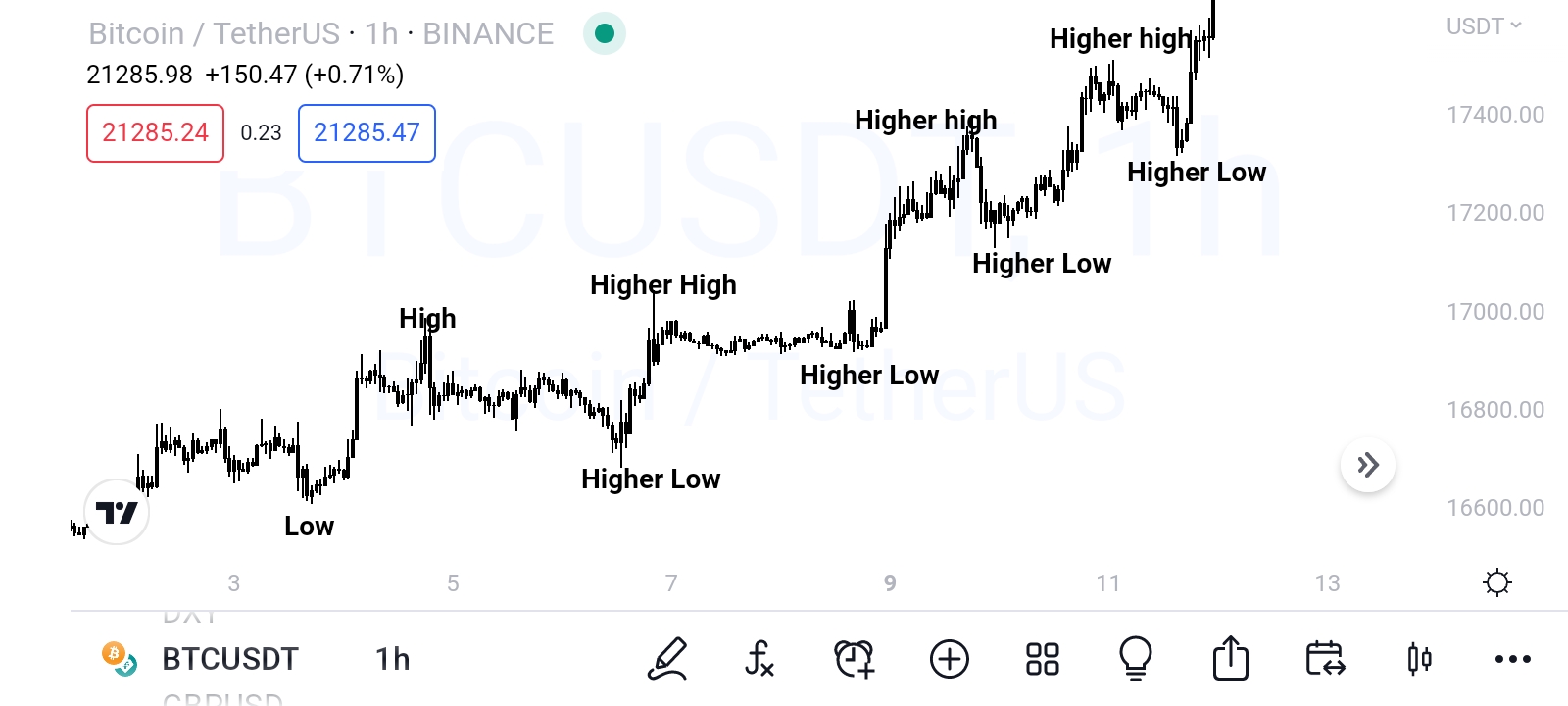

Let’s see what these trends look like in an actual market.

Uptrend

Downtrend

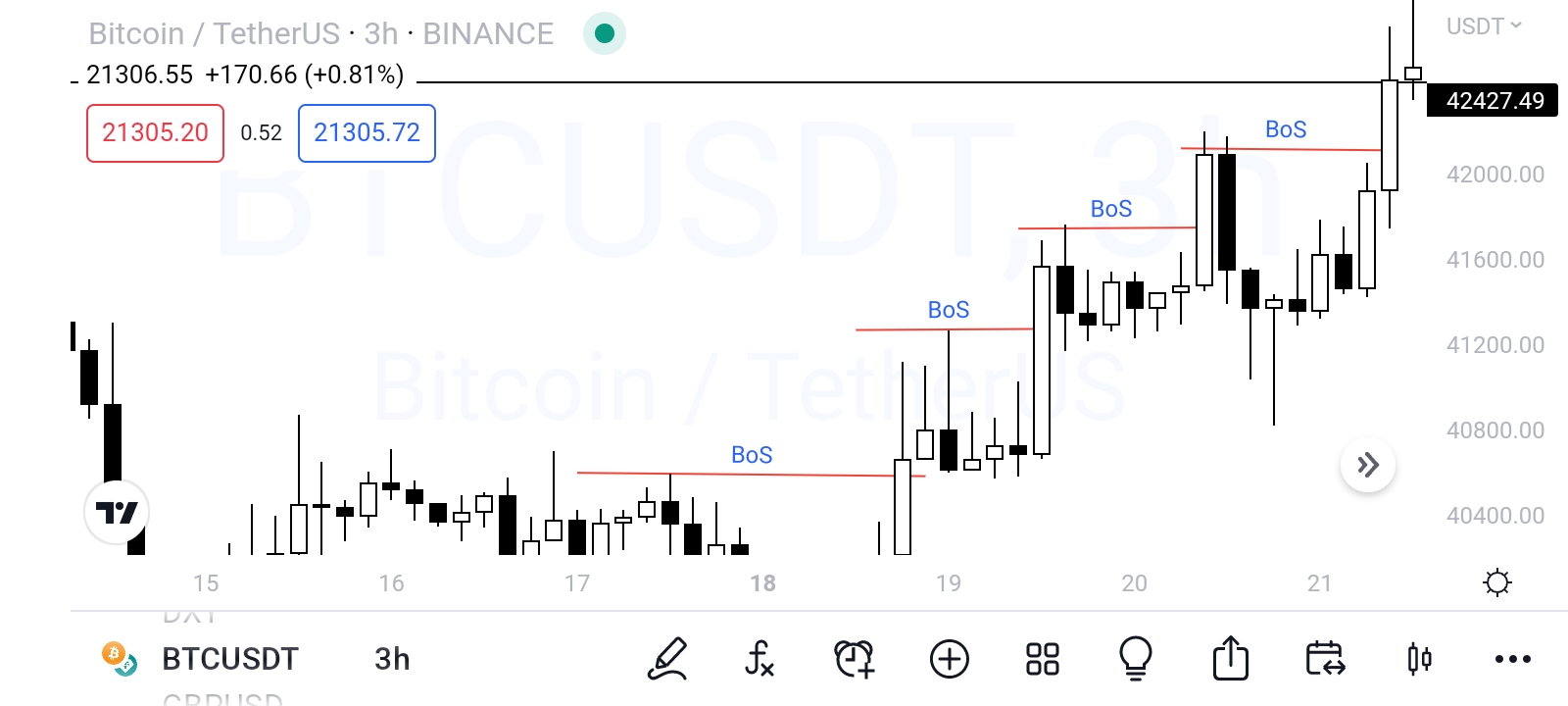

Break of Structure (BOS)

Understanding the consequences of a break in structure helps in the identification of the buyer’s and seller’s strengths.

if you observe properly you will notice that every time a high is broken price prints a HH then pulls back printing a HL then continues the break the high so we label each time it breaks these points as BOS this is to tell us that the price is continuing its move up and buyers are still in power

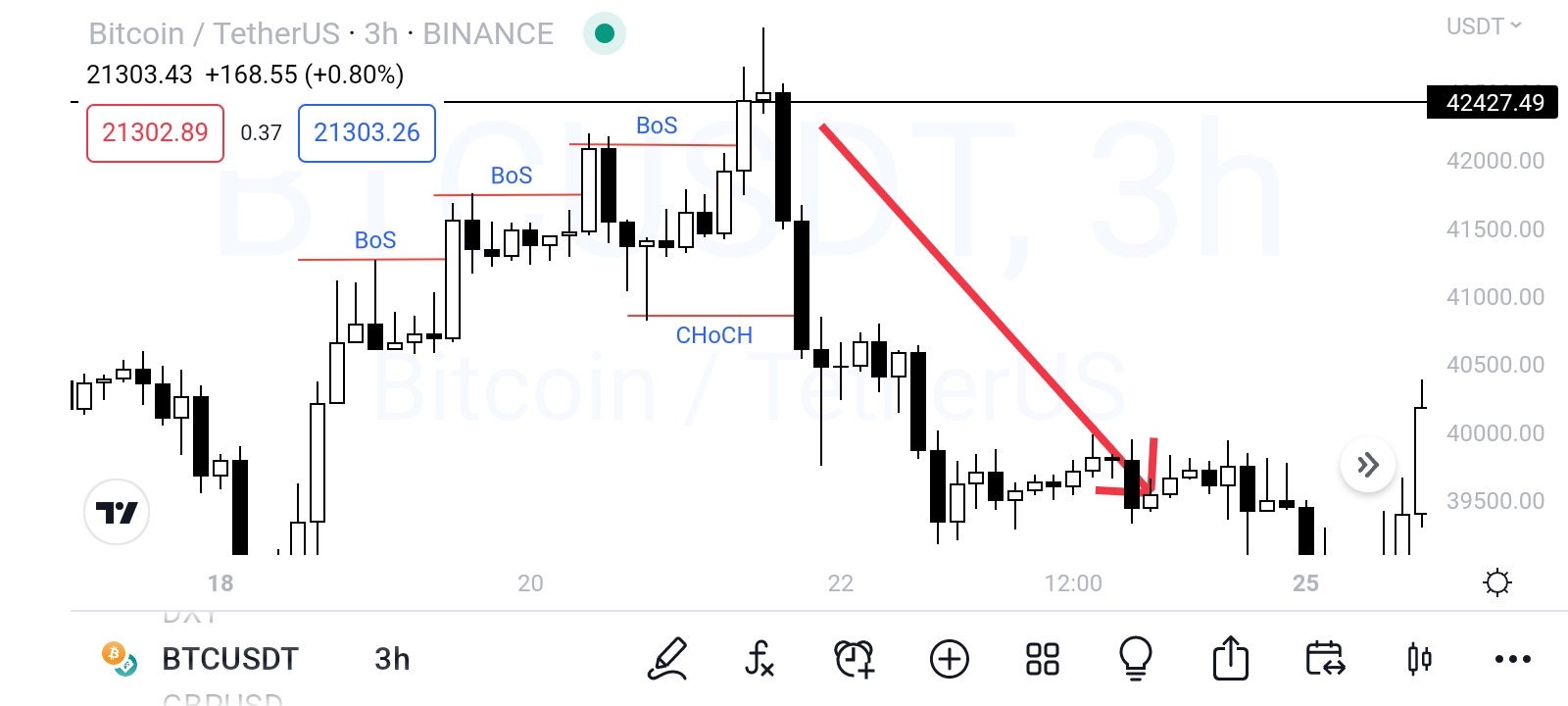

Change of Character

You can see that when price is in an uptrend and the low fails to hold forming a lower low (LL), this indicates a change of character CHoCH, a price pulls back to form a lower high (LH) and continues breaking lows.

It means the sellers are coming into power and a shift in trend is about to happen.

Trading Market Structures

This knowledge is useless if not applied correctly to trading, you will be losing a lot if you are buying at the wrong spots.

Even though you are supposed to buy in an uptrend, buying higher highs (HH) means your stoploss will be large.

The trends tell a story of buyer’s and sellers’ strength because the market moves in the direction of the stronger parries breaking the weaker regions.

That said, let’s look at how we can use these secrets to know when to buy or sell and avoid some of the worst trading mistakes.

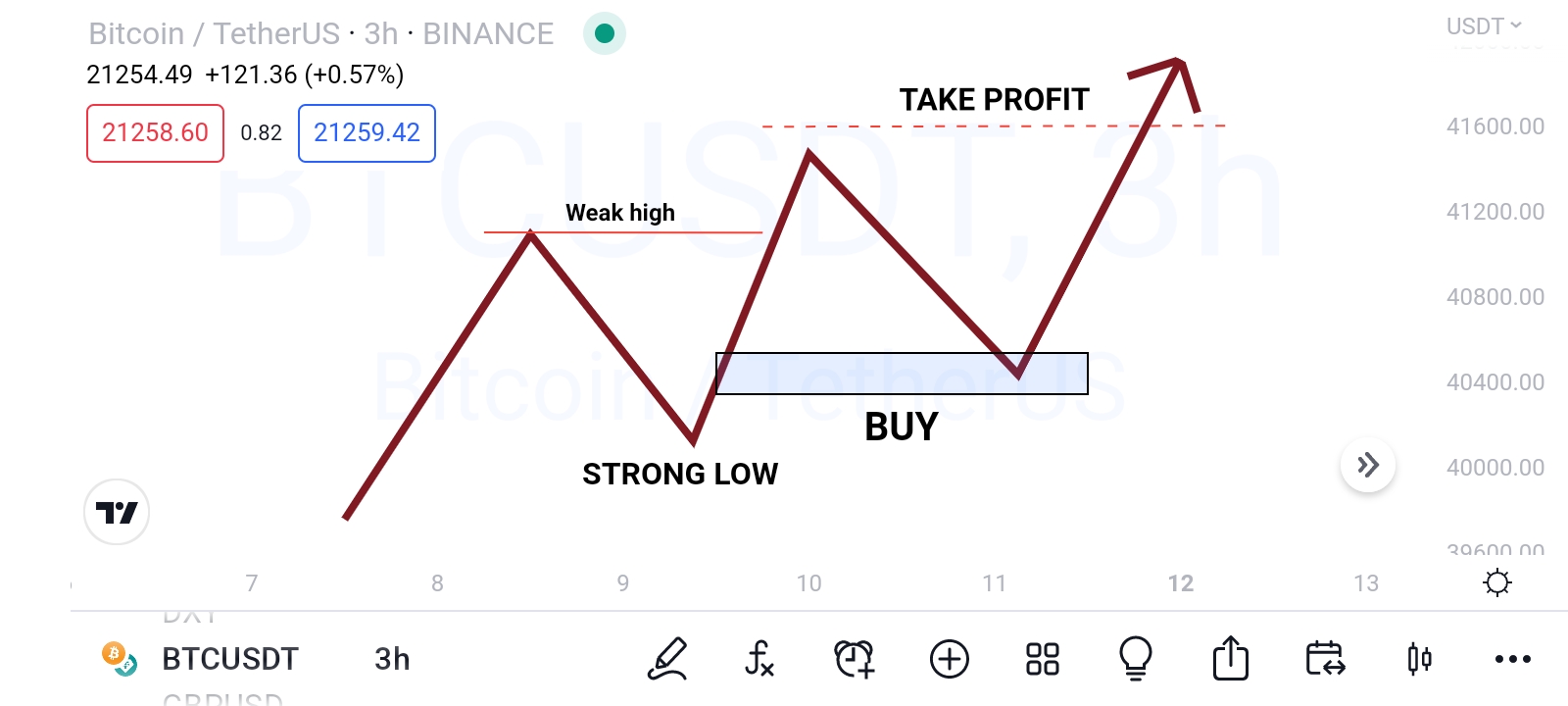

Weak highs

In an uptrend, market continues to move higher by breaking weaker highs.

A high is considered weak when it does not break a low.

So once a high pulls back and couldn’t break the precious low, it forms a higher low (HL) which will likely break it to form a higher high (HH).

Higher highs are weak highs as long as they keep forming higher lows (HL) instead of lower lows (LL)

Strong lows

A low is considered strong when it can resist a breakthrough or breaks a high.

Any low that breaks a high may likely withstand any pull back forming a higher low (HL) and breaking structures upwards to form higher highs (HH).

A HL is considered a strong low as long as it keeps smashing HHs to form new ones and resisting pullbacks.

A strong low is therefore a good spot to enter the market if you want to trade with a very tight and safe stoploss and take profit immediately after it breaks the high.

Weak lows

These are responsible for downtrends, as the market keeps smashing them to form LLs.

Just like it’s not advisable to buy at HH, it is bad to sell at LL as price will buy above it and break through after forming a LH.

Weak lows may not be the best places to sell but they are the perfect spots to exit the market and take profit immediately after they are broken.

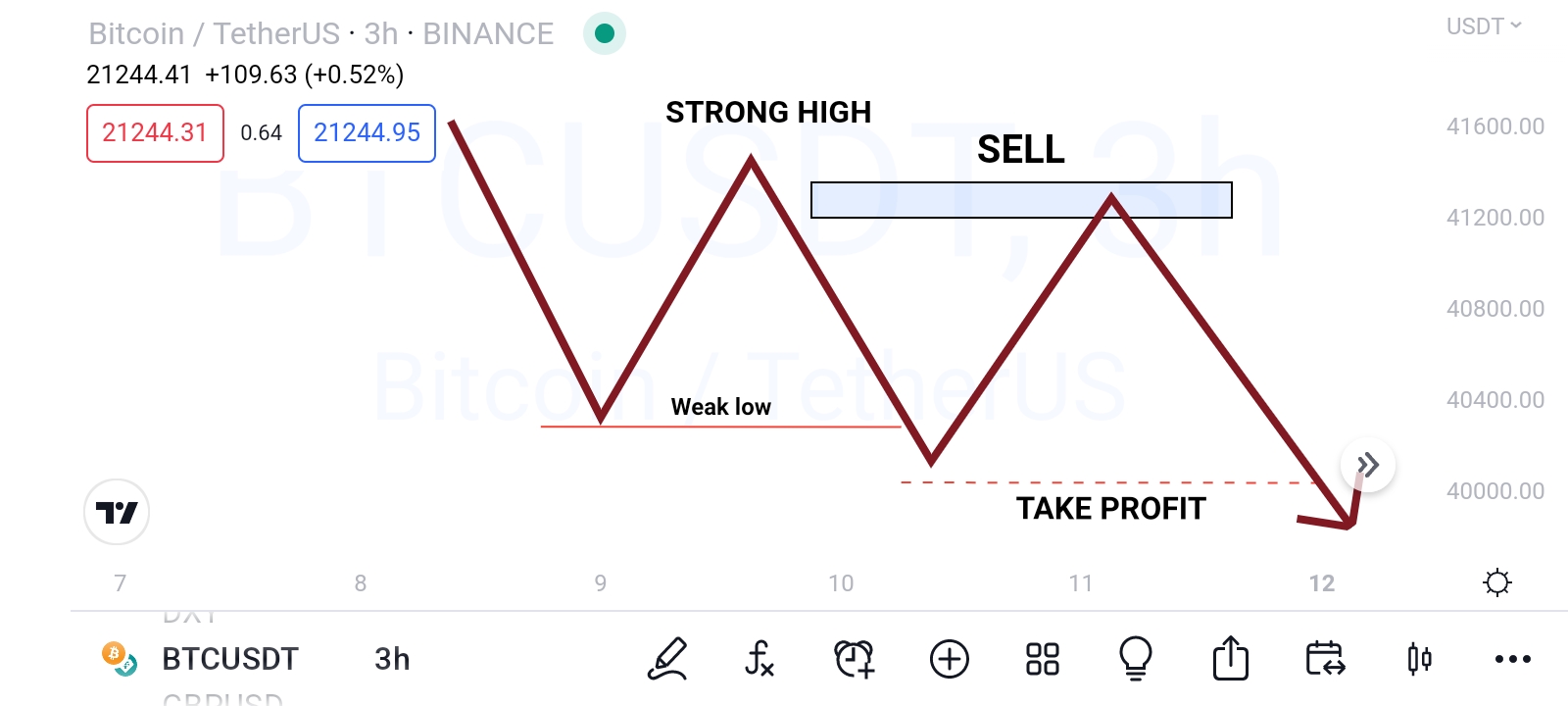

Strong highs

A high is strong when it can resist price from crossing over and also breaks a low.

A download is formed when a strong high keeps breaking lows, and strong highs are the best selling points.

It gives room for a very good risk-to-reward ratio, risk management, and easy profit.

Deadly Mistakes in trading Market structure

I know it’s hard for some people to believe that money can be made from trading market structure alone, without indicators, and so on.

Sometimes, our losses are not because of strategies but our approach.

Here are some reasons why these strategies may not give you the expected result.

Impatience

I can teach you how to trade but not how to wait, that’s a personal assignment that must be handled before it handles you.

You Must learn to wait for

1. Clear setup

Only trade your strategy and avoid the market when you can’t get a clear picture of what the market is doing.

2. Retest

Avoid FOMO, it’s better to miss a trade than to lose 48% of your account.

Dont jump into the market because you see a big move upward, allow that move to a high, form a higher high (HH), and retest to a higher low (HL) where you can take your trade.

Following signals

Any way to lose money is to abandon your strategy to follow someone else’s without knowing which strategy and risk management they are using.

You may be a swing trader and your signal provider may be a scalper that jumps in and out of the market every three to five minutes with very high leverage and lots.

Not calculating risk

if the setup before you is going to cause you to risk too much, let it go.

My risk management strategy is to look at risk first before considering reward because there is no need to take a trade with little reward and higher risk.

Let’s say you have a $2,000 account and you spot an entry that can give you $500, thats 25% profit.

It is pointless taking that trade if you will risk $500 as a stoploss to hold that position.

Not Having a Trading Circle

There is need to have an inner circle of traders using the same strategy to trade.

It is encouraged to belong to a community where you can link up with traders who have the same mindset and strategy as you.

Conclusion

With a sound knowledge of market structure, you will never blow an account because you know when and how to enter and leave the market without fear or greed.

Buying uptrends at higher lows and selling downtrends at lower highs and taking profit immediately after a break of structure.

Make sure you backtest this strategy, master it and give me your feedback.