Liquid staking derivative is one of the latest trends that has changed the entire proof of stake space with its benefits and we will be breaking the entire process down for you to understand how it works and why it is trending.

We can not talk about liquid staking derivatives without knowing what staking is all about.

What Is Staking?

Staking has to do with locking up tokens on a network for a specified period to increase network security, serve as a validator, and also to earn a reward for contributing to the network’s security.

When a token is locked, the user must wait for it to be unlocked before having access to the tokens, preventing users from taking advantage of whatever opportunity that may arise while their token is still locked because the staked tokens are illiquid.

This limitation was solved by the introduction of liquid staking derivatives.

What Are Liquid Staking Derivatives?

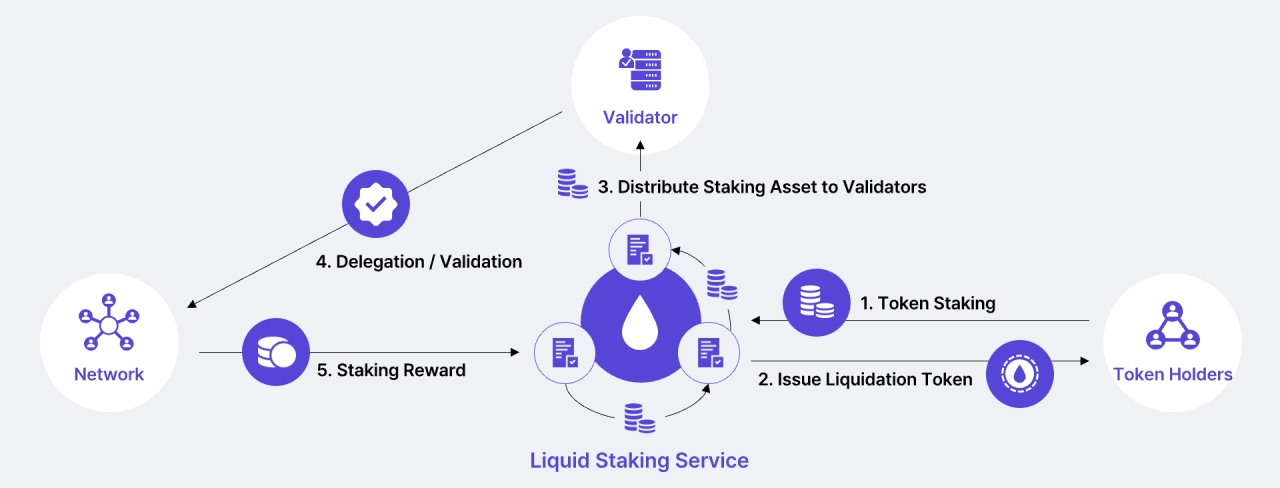

Liquid staking derivatives LSDs are liquid tokens that stand for the user’s staked assets that can be used in Defi activities, which enables them to earn an extra yield alongside their staking rewards.

Ethereum became proof of stake chain after the ETH 2.0 merge, and users can stake ETH and earn a staking reward but the staked token will be locked all through the staking period meaning that users will not be able to jump on another opportunity with the staked asset or even withdraw it to attend to financial emergencies.

So what LSD does when you stake your ETH is to give you a liquid staking token LST that you can use in Defi activities to earn extra yield.

With one of the biggest ETH staking challenges removed, liquid staking has gained massive popularity with Lido leading the table with over $13 Billion total vaule locked (TVL) and other liquid staking providers like Rocket pool, and others holding significant TVL.

Why Is Liquid Staking Derivatives Such A Big Deal

The expected yield for staking ETH is about 3%-6% a year in ETH, but with the introduction of LSD. You can partake in ETH staking with any liquid staking provider and get a receipt for your staking in the form of a token (liquid token) that is fungible, fractional, and transferable.

LSD is a big deal because it gives your staked ETH liquidity, meaning you can carry out Defi activities like selling, lending, borrowing, or even using them as collateral while your ETH is still locked.

Users can now make an extra yield aside from their staking reward.

Are There Liquid Staking Derivatives On Other Chains?

Besides Ethereum, there are LSDs on other chains like Solana which has a liquid staking derivative called “stSOL,” and Avalanche has its own LSD called sAVAX.

Every blockchain network is looking for flexibility and liquidity for its staked assets. Hence, LSD will eventually become a thing for many layer 1, layer 2, and even app-chain tokens in the future.

Bottom Line

Liquid Staking Derivatives have added another way for you to earn more yield from your staked assets by issuing you a liquid token that you can use in Defi activities when you stake on liquid staking providers while your staked asset is still locked. More chains may likely adopt LSD with the rising interest.

Your feedback on our articles helps us to know where and how to improve and make sure you are getting value from this page. I hope to see your review and comment on our handles and don’t forget to follow our X handle for steady updates and crypto news.

DISCLAIMER: Cryptocurrency is very volatile and all the information on this blog is not financial advice so make sure you consult your licensed financial advisor before making any investment decision.