Key Insights:

- Ryan Salame, ex-FTX co-CEO, sentenced to 90 months in prison for financial crimes.

- Salame ordered to pay over $11 million in forfeiture and restitution combined.

- Charges included unlicensed money transmission and illegal political contributions.

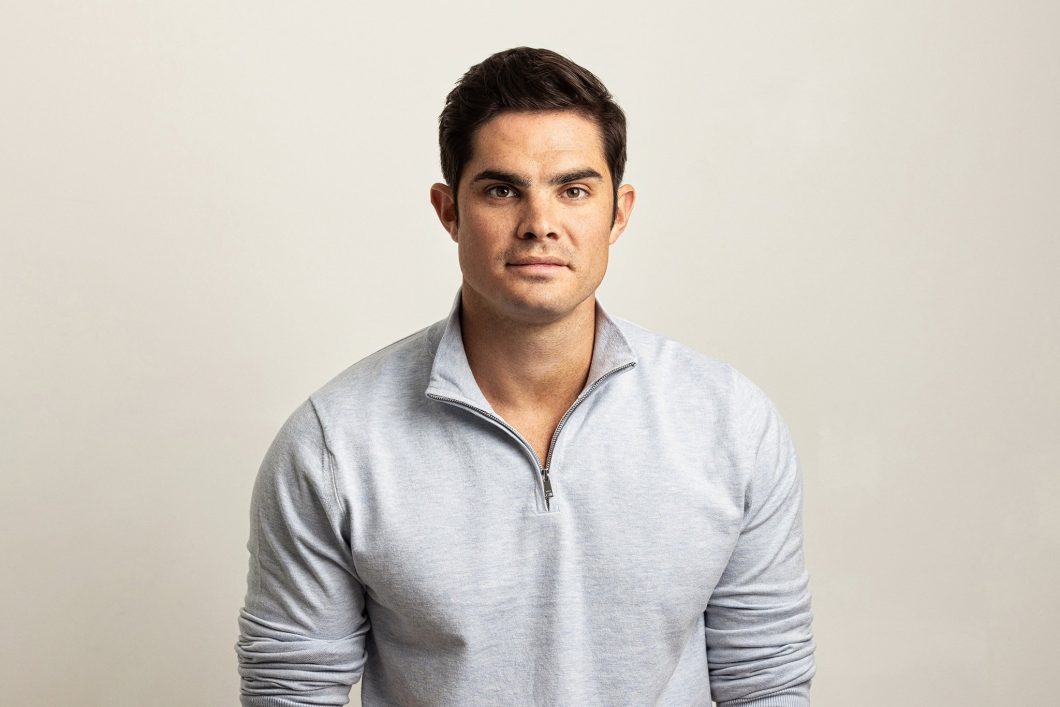

Ryan Salame, previously a top executive at the defunct cryptocurrency exchange FTX, received a 7.5-year prison sentence for his involvement in major financial crimes. This development adds another chapter to the ongoing saga of the FTX collapse.

Former FTX Executive Ryan Salame Sentenced to 7.5 Years in Prison pic.twitter.com/827ILKxSoT

— Altcoin Daily (@AltcoinDailyio) May 28, 2024

Ryan Salame Sentenced

On Tuesday, U.S. District Judge Lewis Kaplan delivered the sentence at the Southern District of New York, imposing a term that exceeded the duration recommended by prosecutors. Initially, government lawyers had suggested a maximum of seven years considering Salame’s guilty plea to conspiracy charges related to illegal campaign contributions and operating an unlicensed money-transmitting business. However, the court ultimately decided on a stricter punishment.

Salame’s legal journey began last September when he admitted to using funds from FTX users to support political campaigns and manage an illegal, unauthorized financial operation. These charges underscored a broader pattern of misuse within FTX, leading to its high-profile bankruptcy in November 2022.

In addition to his prison term, Judge Kaplan ordered Salame to forfeit over $6 million and pay upwards of $5 million in restitution, reflecting the financial impact of his actions. The penalties aim to address both the electoral misconduct and the operational improprieties under his leadership.

This sentencing marks a significant milestone in the legal repercussions following the FTX debacle. Salame, who once served as the co-CEO of FTX’s Bahamian subsidiary, FTX Digital Markets, is the first of Sam Bankman-Fried’s inner circle to face such consequences. His cooperation with authorities, which included revealing financial mismanagement by Bankman-Fried himself, did not significantly lighten his sentence.

The case also highlighted Salame’s extensive political donations, totaling more than $24 million to various campaigns, which he funded through the illicit use of company resources. These revelations have stirred ongoing discussions about the integrity of both political funding and cryptocurrency operations.

The Collapse of FTX

In late 2022, FTX, a previously prominent cryptocurrency exchange, faced a catastrophic collapse. The initial signs of trouble emerged when allegations of financial misconduct and deceit surfaced. It was discovered that FTX had been diverting clients’ funds to support speculative ventures by Alameda Research, a related entity also established by Sam Bankman-Fried.

The situation worsened after a disclosure indicated that a significant amount of Alameda’s holdings consisted of FTT, the digital currency created by FTX. This disclosure caused a loss of trust among investors, prompting a swift departure and request for fund withdrawals. The rapid outflow revealed FTX’s critical lack of liquidity.

Caroline Ellison played a crucial role in uncovering FTX’s illicit actions by informing the Securities Commission of the Bahamas about the company’s malpractices on November 9, 2022. This was shortly before Bankman-Fried stepped down as CEO, and the firm sought bankruptcy protection. Bankman-Fried was later extradited to the United States, faced a trial, and was found guilty of seven criminal charges.

On November 11, 2022, FTX declared bankruptcy, and Bankman-Fried relinquished his role as CEO. The bankruptcy documents showed that FTX was indebted to its creditors for billions and faced a significant deficit in assets. FTX’s downfall created ripples across the crypto market, leading to decreased cryptocurrency values and diminishing investor confidence.

Further probes into the company uncovered widespread deception, mismanagement of customer funds, and inadequate corporate controls. Several top executives, including Bankman-Fried, were indicted for a range of financial offenses. Bankman-Fried’s trial concluded with his conviction on multiple charges and his sentence of 25 years in prison.