When we talk about Best Defi Projects, we need to understand that it also means Best Defi Coins.

Understanding Defi(Decentralized Finance) will give you the reason why we are to search for the best Defi Projects in the crypto space and acquire some for the future.

We are steadily transitioning into the Defi era, so acquainting yourself with the Defi protocol knowledge is not a bad idea.

Remember we discussed that the goal of (decentralized finance) Defi is to remove the power of third parties or intermediaries from a financial transaction. In Defi, you don’t need permission from a centralized body (Bank) to execute any transaction.

You can look at the below article to fully understand Decentralized Finance and DAPPS.

Also, Read UNDERSTANDING DEFI.

Now that you understand Defi, let’s teach you how to know a good Defi Project and how to enter early.

Ethereum is the mother of Defi coins, as it is not just a currency like Bitcoin but it offers room for other crypto operations like Dapps, smart contracts, etc.

So buying Ethereum is a good idea, but since you couldn’t hold Ether early or earlier, you need to catch the early ones and hold them tightly.

Advantages of Defi

Thanks to the Ethereum blockchain for creating massive blockchain offerings. Decentralized finance is a paradigm shift in the finance systems of the world(centralized finance). Right from the introduction of Defi, the world has pictured a way where their funds can be handled and they will feel safe with it. The following are a few advantages of decentralized finance.

- Convenient financial activities: Decentralized finance makes it easy for financial operations to be done conveniently without central bodies/authorities(banks).

- Loans/staking can be done from the comfort of your homes with little charge and without going through the normal stress of centralized platforms.

- Security and transparency: Defi systems are transparent, unlike centralized systems. You can track your payments yourself, without visiting a branch or firm. Also, security is offered through blockchain technology, to make funds traceable and accessible.

How to know the Best Defi Projects

The best Defi projects can be identified by the following;

- Market Capitalization: This is simply the number of funds already invested in the project.

- Current Price: The price matters especially if we want to be early birds in the project. Since we want to be early, we need to look for a project below $3-$5.

- Use Case: From the project’s white paper, what are they solving with their project? The weight of the use case will determine the success of the project.

- Circulation Supply: This is self-explanatory, it tells you about the number of coins circulating. A lesser Circulation supply will bring scarcity and an increase in price in the long run.

- Project Supporters: I often use this setup to determine good projects, because formal successful project developers who venture into a new project can still make the new project successful.

Now let’s see the Best Defi Projects.

From thorough research, the following Defi Projects seem fit, coinmarketcap.

SXP, ANKR, REN, KEEP, CHR.

SXP(SOLAR NETWORK)

Ethereum-based token, SXP is a promising Defi coin that offers great potential. Having a decentralized blockchain, Solar operates with the proof of stake mechanism.

- Market Capitalization– A good market capitalization $847,449,027(below $1B)

- Current Price– With what they are offering, $1.63 is an early price.

- Use Case– The platform offers staking, swap, burning(deflationary), and NFT marketplace in the long run.

- Circulation Supply– A nice market Cap of 479,937,576.00 SXP (below 1B)

ANKR

This Ethereum-based Defi project is built to strive in the WEB 3, where you can build and earn. ANKR offers a lot of goodies which be outlined below.

- Market Capitalization– $921,023,978(below $1B)

- Current Price-The current price is as a result of the circulation supply, $0.09205

- Use Case– offers Defi potentials like staking and liquid pools. Gives developers a building platform, and API/RPC endpoints with WebSockets. Offers multi-chain tools as a foundational layer for Web3, Defi.

- Circulation Supply– This coin has a huge supply of 8.16B ANKR, but was still chosen because of its tokenomics.

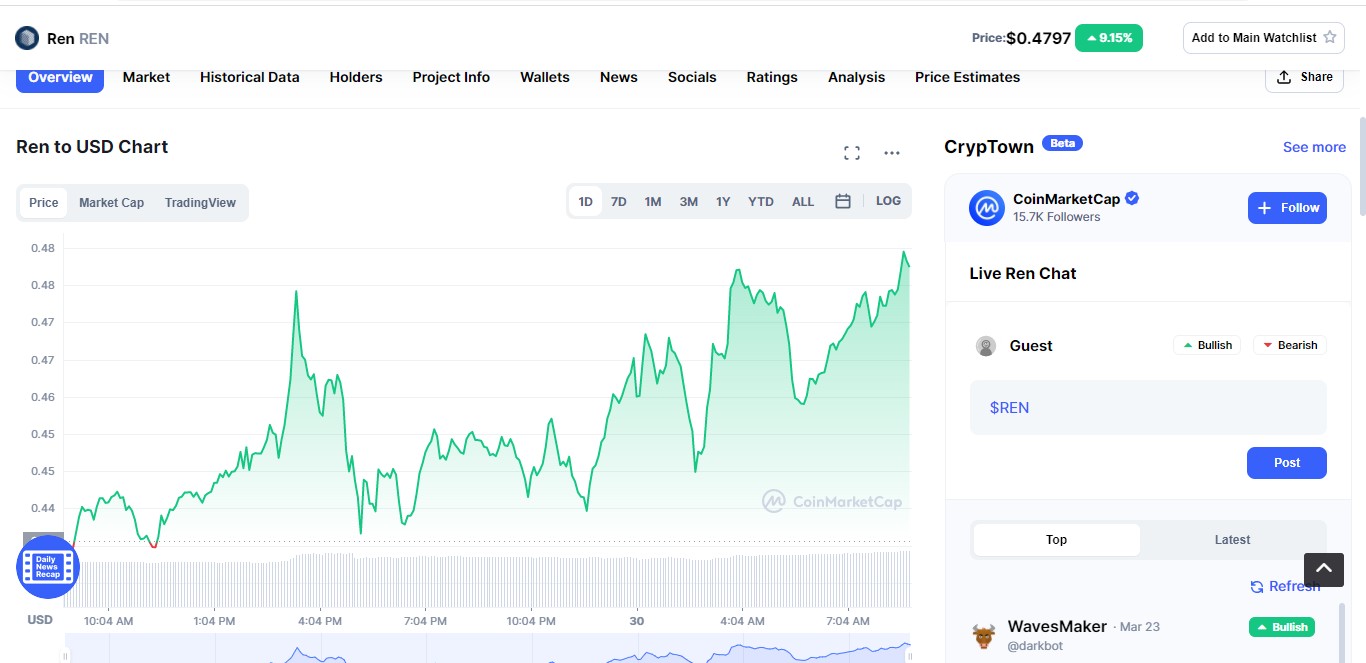

REN

REN is built on the Ethereum blockchain and it powers up Ren’s open protocol for transferring cryptocurrencies between all blockchains. Ren aims to integrate big assets like Bitcoin and Zcash into the Ethereum blockchain. Giving them the ability to associate in a multi-chain decentralized finance ecosystem.

- Market Capitalization– A sweet early market capitalization of $478,709,677 (less than 1$B)

- Current Price– Early $0.4787

- Use Case– creating the ability for users to send currencies between different blockchains.

- Circulation Supply– It has a good circulation supply of 999,037,500.36 REN

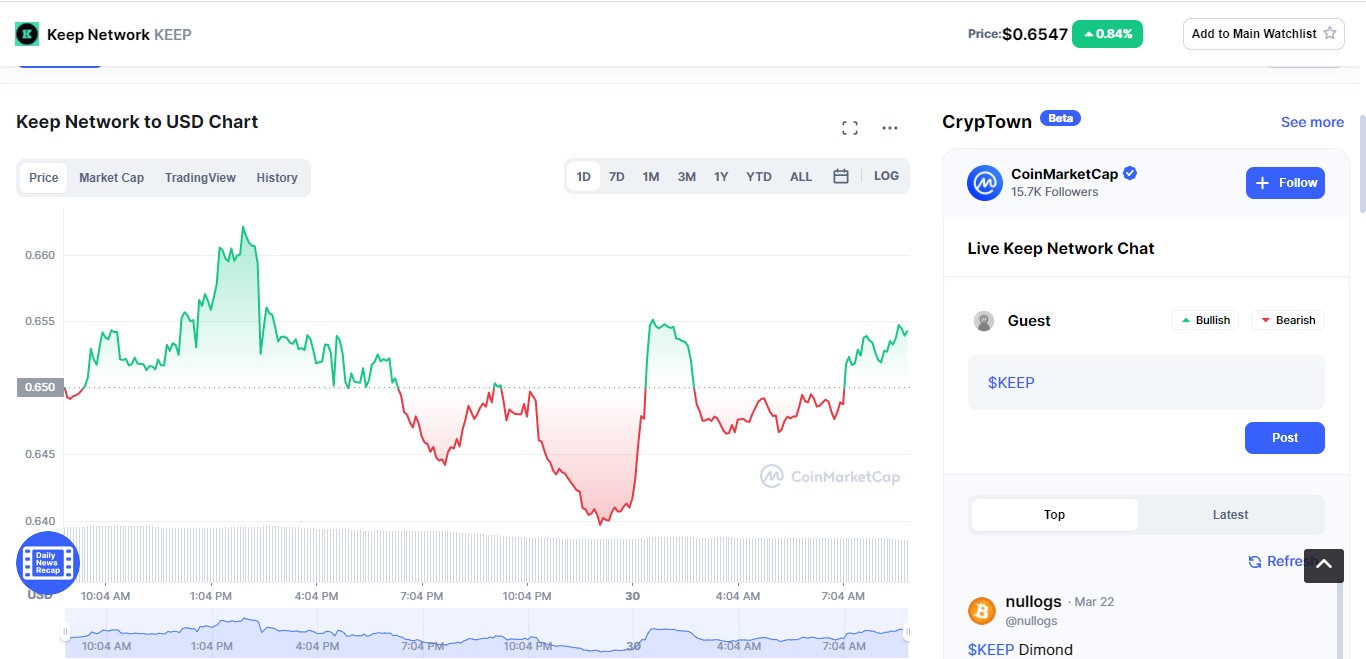

KEEP NETWORK (KEEP)

This project believes in the proof of stake consensus mechanism, giving users the right to stake on a secured decentralized platform. They preserve users’ information even on a public blockchain to show decentralization.

- Market Capitalization– Early market capitalization of $654,338,913

- Current Price– $0.6544

- Use Case– To be the first decentralized project that uses private data on public blockchains without losing its confidentiality. Offers Defi Staking.

- Circulation Supply– Sweet Circulation Supply of 653,221,533.39 KEEP (Less than 1B)

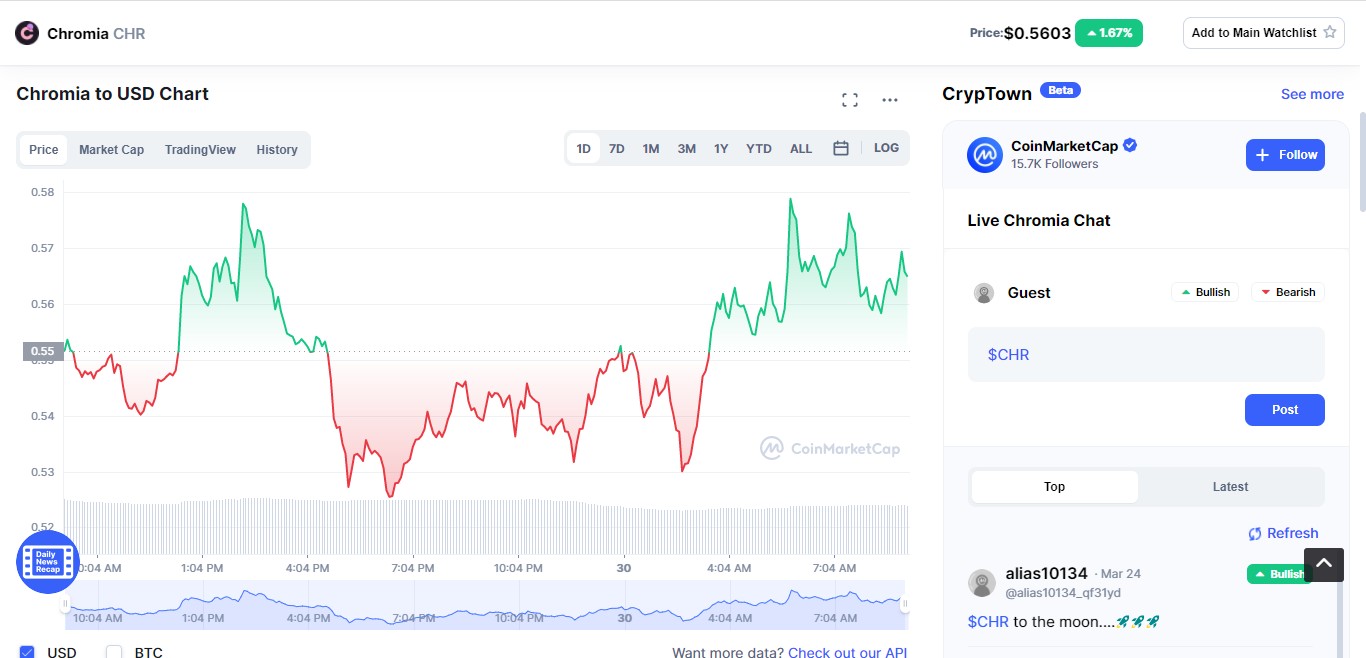

CHROMIA (CHR)

Offers a decentralized blockchain where people can build decentralized apps in the real world.

CHR project offers gaming and metaverse activities, and staking and Dapps attribute.

- Market Circulation– Early market cap of $560,330,631

- Current Price– $0.5603, currently affordable.

- Use case– Gaming, and blockchain for decentralized app hosting.

- Circulation Supply– A sweet circulation supply of 567,369,439.

Conclusion

There are lots of Defi projects in the crypto space, but some have left users behind, because of price factors mainly. The few discussed here are early to acquire with their promising values. Although, Defi coins have not been regulated in the world today, investing in Defi projects is still at your risk.

Disclaimer

Cryptocurrencies are very volatile with a significant level of risk attached to them, you are advised to do your research and trade at your own risk. This article is for research purposes and not financial advice.