The crypto world has been a world of opportunities, and now a lot of scam crypto projects have taken over the space.

It is now up to crypto enthusiasts to watch out for crypto scam projects and stay clear.

Someone who is a professional in any business or firm will be able to determine an original from a fake, and this is the same for a crypto trader or enthusiast, as he or she is supposed to detect a scam crypto project or projects when he/she sees one.

That’s how you know how rooted you are in the crypto space. Although, crypto is not an offline business where you can go to their offices and ask questions, or where you can visit and have an eye survey of the business. Everything is done online and thus, the probability of detecting a fraudulent project is low in the crypto space.

Many crypto projects without use cases(use case means the problem a crypto project will solve or is solving) have done well over the years and till now still topping the chart by huge market capitalizations. So if you were to judge the project based on the use case, you would have deemed it a scam project, but till now it is surviving and doing well more than the few with use cases.

Quickly, let’s see how we can detect scam crypto projects.

How do we know about scam crypto projects?

- White paper not complete and feasible

Every crypto project must have a white paper that will always reveal some important information about the project at hand.

The information revealed by a white paper includes the goals and objectives of the crypto project, the strategy for achieving the goal, and the schedule of project implementation.

A comprehensive white paper should have a SWOT analysis, where the crypto developers document their internal strength and their weaknesses, relating to external strengths and opportunities.

So any crypto project that doesn’t have these potentials should be followed with caution, that is, if you must follow.

Secondly, a good white paper without a laydown of feasible execution is also a red flag. For example, a white paper that says the circulation of coins will be reduced every month but didn’t show how the circulation can be reduced every month.

- No use case

Any project that solves problems will always grow and once a business stops solving problems it dies gradually. So we have a lot of problems in the crypto space and any new project can come in to solve one or two. Any crypto project that is not moved by purpose will not grow. Even if it grows, it will fall.

A use case should also be feasible, meaning that the solution to the problem should be realistic and not a just paper-bound solution. We have seen projects with good use cases, but no proper or documented method for achieving the use case. Even if a documented method is given, how possible is it? How feasible is the method?

All these should be sorted out.

- Moved by hype

You should understand that some coins are only moved by hype and the growth cannot be sustained by hype. Such coins are seasonal and shouldn’t be taken seriously.

If possible stay clear from such as you don’t know when it will plummet.

- Hidden information

Apart from the world’s first cryptocurrency, Bitcoin, whose founder is anonymous to date. Don’t rush into projects you know nothing about and even when you should, invest wisely and take profits earlier.

- Insecure Sites

Thanks to some browsers like chrome that show the security of a site, by showing the padlock at the top left of the browser. If the site is not secured, you would see the angle caution sign to show how vulnerable the site is. Such sites are not safe and entering is at visitors’ risk. This key is not to be taken singlehandedly, because some sites are secured but still fraudulent. So, use the key with the confluence with the other keys given here.

- Too good to be true ROI(Return on Investment)

No matter how sure an investment seems to be, the ROI should be realistic and feasible. Any crypto platform promising you a big ROI that is “too good to be true” (unrealistic) should be dropped. Some people are too greedy that they would see a promised ROI of 50 percent or above and they will zoom into the business. Remember if a business is that profitable, you won’t see it online, they will hold the update for their generation.

So watch out for platforms with “too good to be true” ROI.

- A request for private information

The information requested from any crypto project should be carefully read and processed. Avoid consenting to any smart contract transaction. Any crypto projects that ask for private keys should be abandoned immediately.

Also, any crypto project with hidden facts or ownership shouldn’t be given attention.

Conclusion

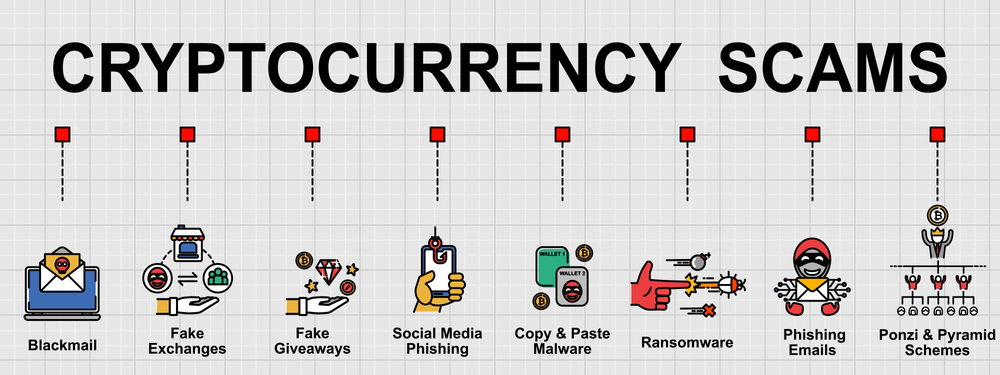

The issues of crypto scams should be taken seriously, because of the damage it causes to the crypto ecosystem.

A lot of people are skeptical to invest in cryptocurrencies, because of the already painted image of scams in the crypto space. This has made many crypto project developers highly acquaint their masses with crypto scam-detecting abilities. Some firms will always tell their audience, “none of us can privately contact you”. This is great because some of your users are contacted by scammers who claim to be an official of the firm. The normal department used for scamming is the customer service department, and the targeted public is only beginners/newbies.

The above points are not 100percent certain, but they should guide you in choosing a good cryptocurrency to buy or a crypto project to invest in and also knowing scam crypto projects. Currently, some coins are making waves only by hype, and such coins should be watched very closely. Remember, the crypto space is filled with opportunities for development and also for retrogression.

Disclaimer

The above article is only for informational purposes and not for financial advice. You are hereby advised to do your research(DYOR), and trade at your own risk.