Bitcoin has continued at its pace by dominating the whole crypto market. This has made traders analyze Bitcoin charts before trading any other cryptocurrency(ALTS).

This week started with Bitcoin’s consolidation at the 46k support, and finally, the week has seen a massive decline in the price of Bitcoin, raising so many concerns as some say it’s the Bitcoin DIP of 2022.

With the above, a bearish season has been confirmed as the technical analysis wasn’t able to play out this time around.

Meanwhile, we have found out that people mistake retracements for dips in the crypto space, and we are going to explain Bitcoin dip and the causes of Bitcoin dip.

Bitcoin dip meaning

A dip in the crypto space is the massive decline in the value of a cryptocurrency. See how the word massive was written boldly in the sentence. We have noticed that any little price decline (retracement) of Bitcoin will always lead to panicking with DIP talks and FUD from crypto traders. Some people mistake retracement for DIPs and it’s a big problem in the crypto space.

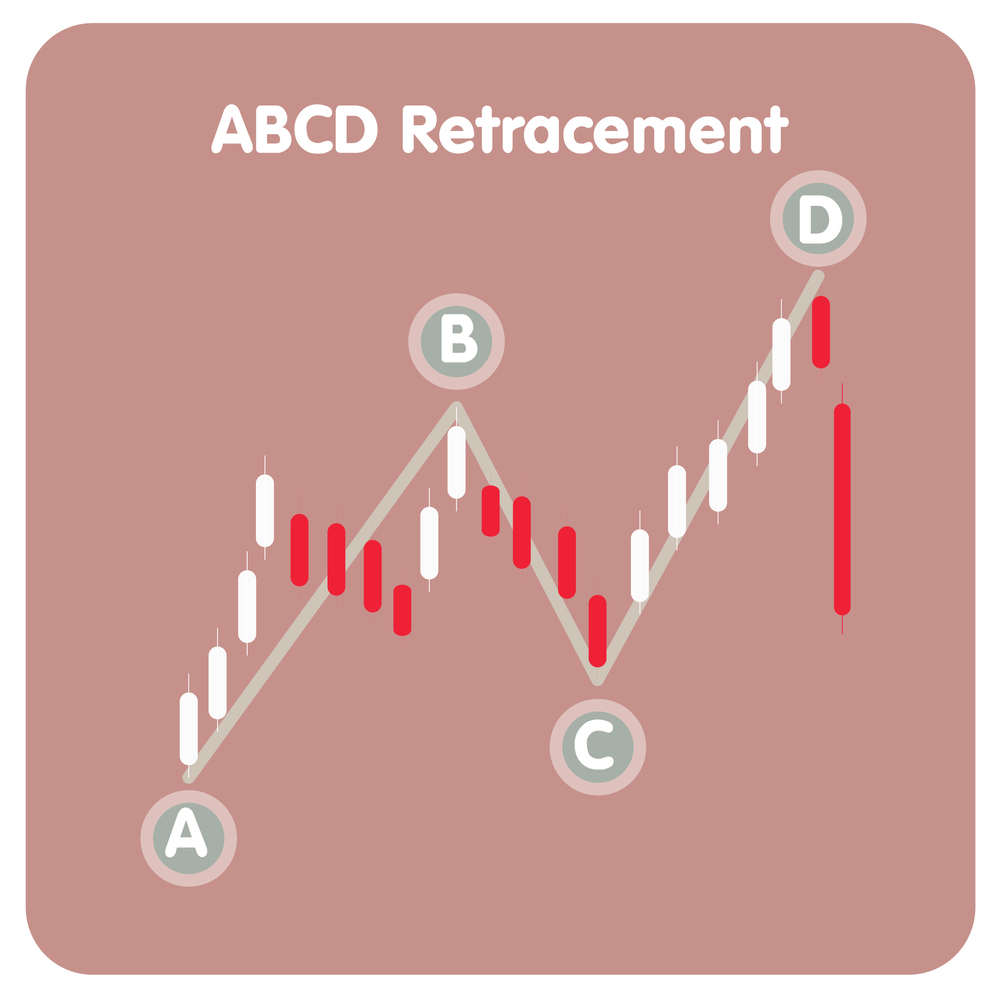

What is Retracement?

Retracement is just a minor backward or forward change in the price movement of a currency. By retracement, we mean a little pullback in the price of a cryptocurrency. We know that the price of a currency cannot move steadily above or below, there must be some fluctuations and that’s what we call retracements. Retracement doesn’t alter the trend but it defines the trend. This means retracement is never a problem in the crypto space as currencies must make retracements to define their current trend.

What causes Bitcoin Dip?

Bitcoin dip has been occurring over the years with the world’s first cryptocurrency, Bitcoin bouncing back after several dips.

This has always defined the strength of Bitcoin and has gained the trust of investors and institutions.

Dip occurs as a reverse impulse action.

Whenever Bitcoin gets a strong buying momentum that pulls the price so high and thus breaks trends/patterns.

There must be a reverse impulse to correct the formal high impulse.

That reverse impulse is called correction and that’s what we call Bitcoin Dip.

To confirm this, recall when Bitcoin massively clinched an ATH of $64.9k in 2021. It took a few weeks before the correction started, and Bitcoin corrected its price to a low of $34k. This was a shocking Dip in the crypto space which led to a few dents in ALTs.

It is obvious that some traders are not always shocked when Bitcoin dips, as they already understand the principle of Bitcoin dip. The uncertainty lies in the day or time of DIP, but it can be predicted.

So the only better thing to do if you are caught unawares in a DIP is to, buy the DIP.

Secondly, the Bitcoin dip is heightened when people begin to sell because of fear, uncertainty, and doubt(FUD). When it comes to selling during dips, some sell because of fear, while some sell off to buy the dip at the bottom. Both will lead to a continues dip until bulls become alive once more.

And buying the DIP can occur in stages since you are not sure of where and when the DIP might end.

So you can set buying orders on different supports, so whenever the previous support is neglected, your second order can be triggered.

SEE THIS ARTICLE ON WHAT TO DO DURING BITCOIN DIP

Making use of Bitcoin Dip

No matter how frustrating the Bitcoin dip could be, we still have a few ways of leveraging on it and making profits in the long run.

The following are used in making profits from dips;

- Buying at the bottom: Buying the dip is very difficult because the dip continues dipping at times, smiles. Therefore, looking for the right bottom to enter the market becomes difficult. If you would want to see the initial bottom where bitcoin will find support, then you have to look for a validated demand/supply zone. During a dip, demand and supply zones are where institutions are looking to enter the market. Sluggishly, Bitcoin will move to that region before gaining momentum to bounce back. Currently, the $33k region is the demand/supply zone for Bitcoin.

- Shorting Bitcoin: This method works well for futures traders who understand where the dip might be heading to. Recall that we advised that futures trading should be avoided during dips. Yes, it should, but if you are familiar with the market, you can leverage on it and make profits. You have to find a demand zone that Bitcoin might likely hit, then short it using stop losses, in case it goes sideways. This method is risky and profitable.

- Convert to stablecoins and buy the Dip: Dip continues dipping when people sell off or convert their Bitcoin into stable coins to buy the dip. It looks like an investment but it affects the crypto space. However, instead of watching your portfolio turn red, you can convert it to a stable coin and buy the dip. This method is also risky as you might not know where Bitcoin might be heading to. So, if you are not familiar with the market, you can exit it or risk it.

Conclusion

The crypto market is a very sensitive and neutral market, so any action will always be felt and can however trigger a positive or negative market action.

The promising feature of Bitcoin is the high bounce volatility and how it recovers from DIPs. Checking the history and price chart of Bitcoin, you will see the different Dip prices of Bitcoin and how it managed or strived to come up bullish.

Fundamentally, Bitcoin is bullish and the anticipated Bitcoin bullish news might hit the crypto space soon. So obviously the DIP is not a lasting one, but all trades should be held with stop losses, and risk management procedures should be equally followed.

Disclaimer

Cryptocurrencies are volatile with a significant amount of risk. This article is for informational purposes and not financial advice.